Once a year, the Tax, Accounting and Controlling Committee of the German-Russian Chamber of Commerce organizes a tax conference.

The tax law and tax system of Russia are the focus of the tax conference of the German-Russian Chamber of Commerce. Among other things, the following topics were discussed:

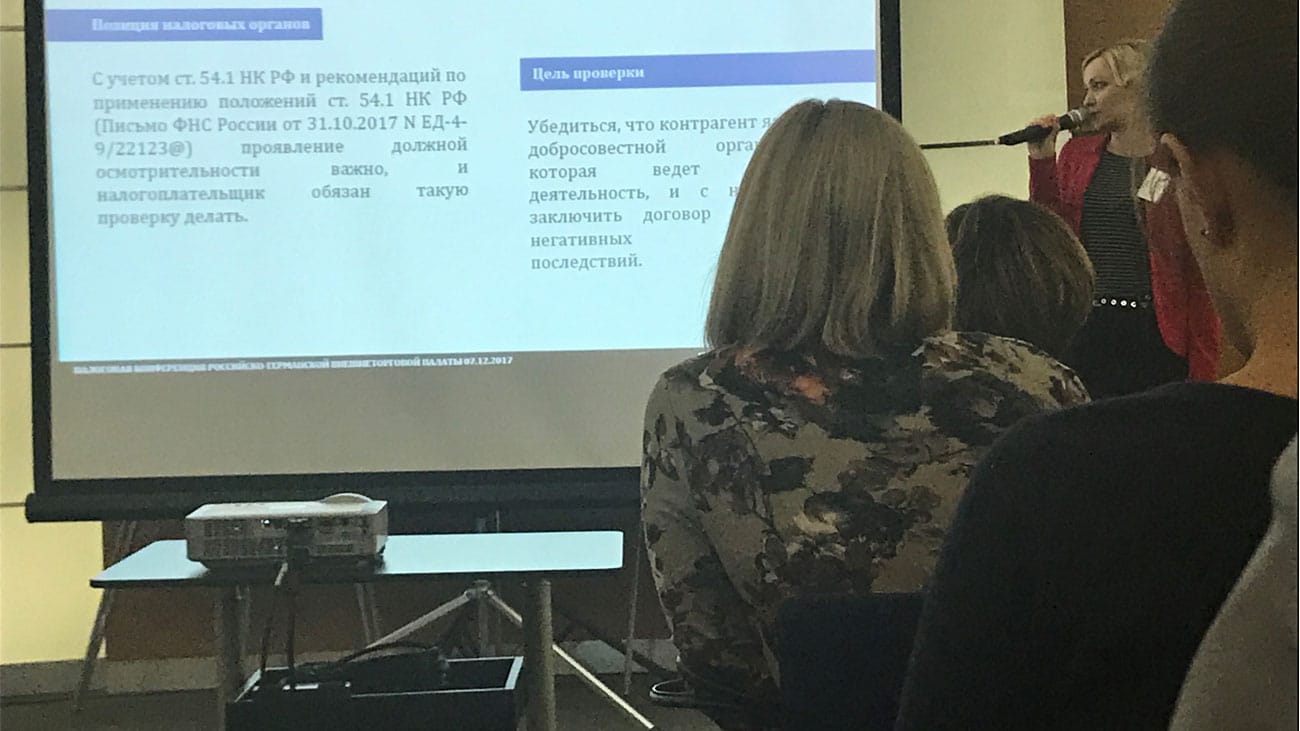

The managing director of “Sterngoff Audit” gave the presentation “Joint Responsibility of the Counterparties – Due Diligence”. In particular, it looks at the main changes introduced by Article 54.1. “Limits on the exercise of rights in the calculation of the tax base and (or) the amount of taxes, collection, insurance premiums.” entered into the tax code of the Russian Federation.

Your application has been successfully accepted.

We will contact you shortly.

We have sent an email to your email, please confirm your subscription by clicking on the link in the email.